Commerce Finds Dumping and Subsidization of Imports of Drawn Stainless Steel Sinks from China

On February 20, 2013, the Department of Commerce (Commerce) announced its affirmative final

determinations in the antidumping duty (AD) and countervailing duty (CVD) investigations of

imports of drawn stainless steel sinks from China.

The AD and CVD laws provide U.S. businesses, workers, and farmers with a transparent and

internationally approved mechanism to seek relief from the market distorting effects caused by

injurious dumping and subsidization of imports into the United States, and thus to have an

opportunity to compete on a level playing field.

For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the

United States at less than its fair value. For the purpose of CVD investigations, countervailable

subsidies are financial assistance from foreign governments that benefit the production of goods from

foreign companies and are limited to specific enterprises or industries, or are contingent either upon

export performance or upon the use of domestic goods over imported goods.

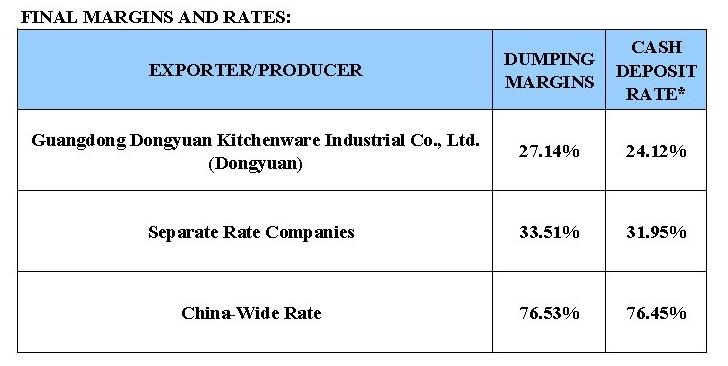

Commerce determined that drawn stainless steel sinks from China have been sold in the United States

at dumping margins ranging from 27.14 percent to 76.53 percent.

Commerce also determined that drawn stainless steel sinks from China have received countervailable

subsidies ranging from 4.80 percent to 12.26 percent.

As a result of the final AD determination, Commerce will instruct U.S. Customs and Border

Protection (CBP) to collect cash deposits equal to the applicable weighted-average dumping margins.

As a result of the affirmative final CVD determination, Commerce will order the resumption of the

suspension of liquidation and require a cash deposit equal to the final subsidy rates if the U.S.

International Trade Commission (ITC) issues a final affirmative injury determination.

In the CVD investigation, Commerce concluded that all producers and exporters benefited from both

export and domestic subsidies. In the AD investigation, the Commerce determined that certain

countervailable domestic subsidies were passed-through to the price of the subject merchandise of

one mandatory respondent, Dongyuan, and the companies receiving a separate rate. Therefore, in

accordance with the statute, Commerce adjusted the AD margins, where appropriate, to account for

the domestric subsidies. Further, if the ITC issues an affirimative final determination, Commerce

will order the resumption of the suspension of liquidation in the CVD investigation and reduce the

AD cash deposit rates, as appropriate, for the export subsidies received.

The petitioner for these investigations is Elkay Manufacturing Company (IL).

The merchandise covered by these investigations is drawn stainless steel sinks from China. Drawn

stainless steel sinks are stainless steel sinks with single or multiple drawn bowls and a smooth basin

with seamless, smooth, and rounded corners.

Specifically excluded from the scope of these investigations are stainless steel sinks with fabricated

bowls. Fabricated bowls do not have seamless corners, but rather are made by notching and bending

the stainless steel, and then welding and finishing the vertical corners to form the bowls. Stainless steel

sinks.

Imports of the subject merchandise are provided for under Harmonized Tariff Schedule of the United

States (HTSUS) 7324.10.0000 and 7324.10.0010. These HTS numbers are provided for convenience

and customs purposes only; the written description of the scope is dispositive.

In 2011, imports of drawn stainless steel sinks from China were valued at an estimated $118 million.

NEXT STEPS

The ITC is scheduled to make its final injury determination on or before April 5, 2013.

If the ITC makes an affirmative final determination that imports of drawn stainless steel sinks from China materially injure, or threaten material injury to, the domestic industry, Commerce will issue AD and CVD orders. If the ITC makes a negative determination of injury for China, the investigations will be terminated.

determinations in the antidumping duty (AD) and countervailing duty (CVD) investigations of

imports of drawn stainless steel sinks from China.

The AD and CVD laws provide U.S. businesses, workers, and farmers with a transparent and

internationally approved mechanism to seek relief from the market distorting effects caused by

injurious dumping and subsidization of imports into the United States, and thus to have an

opportunity to compete on a level playing field.

For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the

United States at less than its fair value. For the purpose of CVD investigations, countervailable

subsidies are financial assistance from foreign governments that benefit the production of goods from

foreign companies and are limited to specific enterprises or industries, or are contingent either upon

export performance or upon the use of domestic goods over imported goods.

Commerce determined that drawn stainless steel sinks from China have been sold in the United States

at dumping margins ranging from 27.14 percent to 76.53 percent.

Commerce also determined that drawn stainless steel sinks from China have received countervailable

subsidies ranging from 4.80 percent to 12.26 percent.

As a result of the final AD determination, Commerce will instruct U.S. Customs and Border

Protection (CBP) to collect cash deposits equal to the applicable weighted-average dumping margins.

As a result of the affirmative final CVD determination, Commerce will order the resumption of the

suspension of liquidation and require a cash deposit equal to the final subsidy rates if the U.S.

International Trade Commission (ITC) issues a final affirmative injury determination.

In the CVD investigation, Commerce concluded that all producers and exporters benefited from both

export and domestic subsidies. In the AD investigation, the Commerce determined that certain

countervailable domestic subsidies were passed-through to the price of the subject merchandise of

one mandatory respondent, Dongyuan, and the companies receiving a separate rate. Therefore, in

accordance with the statute, Commerce adjusted the AD margins, where appropriate, to account for

the domestric subsidies. Further, if the ITC issues an affirimative final determination, Commerce

will order the resumption of the suspension of liquidation in the CVD investigation and reduce the

AD cash deposit rates, as appropriate, for the export subsidies received.

The petitioner for these investigations is Elkay Manufacturing Company (IL).

The merchandise covered by these investigations is drawn stainless steel sinks from China. Drawn

stainless steel sinks are stainless steel sinks with single or multiple drawn bowls and a smooth basin

with seamless, smooth, and rounded corners.

Specifically excluded from the scope of these investigations are stainless steel sinks with fabricated

bowls. Fabricated bowls do not have seamless corners, but rather are made by notching and bending

the stainless steel, and then welding and finishing the vertical corners to form the bowls. Stainless steel

sinks.

Imports of the subject merchandise are provided for under Harmonized Tariff Schedule of the United

States (HTSUS) 7324.10.0000 and 7324.10.0010. These HTS numbers are provided for convenience

and customs purposes only; the written description of the scope is dispositive.

In 2011, imports of drawn stainless steel sinks from China were valued at an estimated $118 million.

NEXT STEPS

The ITC is scheduled to make its final injury determination on or before April 5, 2013.

If the ITC makes an affirmative final determination that imports of drawn stainless steel sinks from China materially injure, or threaten material injury to, the domestic industry, Commerce will issue AD and CVD orders. If the ITC makes a negative determination of injury for China, the investigations will be terminated.